互联网金融参与者行为与风险识别研究毕业论文

2020-06-10 22:02:10

摘 要

互联网金融这个概念产生于十几年前,从2013年开始进入了发展的快车道,它不仅给传统金融行业注入活力,而且对实体经济的运行也产生了深远的影响。这种新型金融业态使广大难以从银行取得资金支持的中小型企业获得了资金支持,有利于市场经济微观主体的发展和市场体制机制的完善。同时,互联网金融带来的问题也是频繁发生,各种平台违约、非法集资的新闻不绝于耳。这就需要我们准确地分析互联网金融参与者的各种行为,从它们的行为中发现问题,在问题中识别出可能蕴藏的风险。并对常见的风险加以分析,在认清风险的基础上提出合理的解决方案和监管对策,规范互联网金融参与者的行为,确保互联网金融长远、健康发展。

本文共分为六部分:第一章为绪论,介绍了研究的背景与意义,论文的结构框架,研究思路,可能的创新与研究不足。第二章为文献综述,通过阅读大量的文献总结了目前我国学界对互联网金融的研究现状。第三章介绍了互联网金融的主要参与者的类型,在对参与者类型划分时,采用了宏观经济学和货币银行学的基本思路,并结合互联网金融的具体实际进行了拓展,即划分为投资者,平台,借款者三大类,分类介绍了他们的特点。第四章基于第三章的分析,介绍了互联网金融参与者的行为,即投资者的投资消费行为,平台的融资放贷行为,借款者的生产经营行为,着重指出了它们的行为中经常出现的问题,正是这些问题的存在为风险的产生埋下了隐患。第五章基于第四章的分析,分类介绍了参与者面临的常见风险类型,深入分析了这些风险产生的原因。第六章基于前三章的分析,介绍了风险监管的整体思路,并且针对第五章提出的各种不同类型的风险,指出了相应的解决方案。

关键词:互联网金融参与者;行为;风险识别;风险监管

An Inquiry into the Behavior with Risk Identification of the Internet Financial Participants

ABSTRACT

The concept of Internet finance has been came into being more than a decade ago,and it entered the fast track of development since 2013.It not only pours the vitality into the traditional financial industry, but also produces a far-reaching impact on the real economy. This new financial format makes the small and medium-sized enterprises which have difficulties to obtain financial support from the banks to obtain financial support,this will benefit the development of the market economy and the improvement of the market mechanism.But the Internet financial makes problems in a high frequency,such as a variety of platform defaults, illegal fund-raising and so on. This requires us to analyze the behavior of Internet financial participants accurately, discover the problems from their behavior, identify risks from the problems.We should also analysis the common risks, put forward reasonable solutions and supervision countermeasures which are based on the risk identification, regulate the behavior of Internet financial participants, ensure the long-term and healthy development of Internet finance.

This article is divided into six parts: the first chapter is the introduction, introduces the background and significance of the research, and the structure of this paper, possible innovations and research deficiencies. The second chapter is the literature review, through reading a large number of documents, summed up the current research on Internet finance in China's academic circles. The third chapter introduces the main types of Internet finance participants,adopts the basic ideas of macroeconomics and monetary theory, and extends the theory combined with the concrete practice of Internet financial development.We divides the participants into the platforms, investors, borrowers in three categories, and introduces their characteristics. The fourth chapter bases on the analysis of the third chapter, introduces the behavior of Internet finance participants, such as the investor's investment and consumption behavior, the platform’s financing and lending behavior, the borrower’s production and operation behavior, pointing out the common problems in their behavior and the hidden risks duo to the existence of these problems.The fifth chapter bases on the analysis of the fourth chapter, introduces the types of risks faced by the participants, and analyzes the causes of these risks. The sixth chapter bases on the analysis of the above three chapters, introduces the whole idea of risk supervision, and points out the corresponding solutions according to the risks analyzed in the fifth chapter.

Key words:Internet financial participants;behavior;risk identification;risk regulation

目录

第一章 绪论 4

1.1 问题提出的背景和意义 4

1.2研究思路和结构框架 4

1.3 可能的创新与研究不足 6

第二章 文献综述 6

2.1 互联网金融发展现状研究 6

2.2 主要参与者类型与行为问题的探讨 7

2.3 金融风险识别问题的研究 7

2.4 金融风险监管措施的讨论 8

第三章 互联网金融参与者主要类型及特点 9

3.1 互联网金融简介 9

3.2 互联网金融参与者之一:投资者 11

3.3 互联网金融参与者之二:中介平台 13

3.4 互联网金融参与者之三:借款者 15

第四章 互联网金融参与者的行为及影响因素 18

3.1 投资者行为分析 18

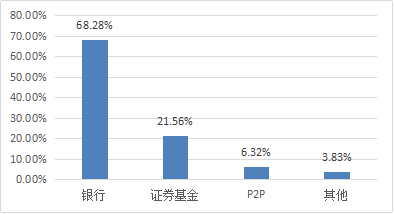

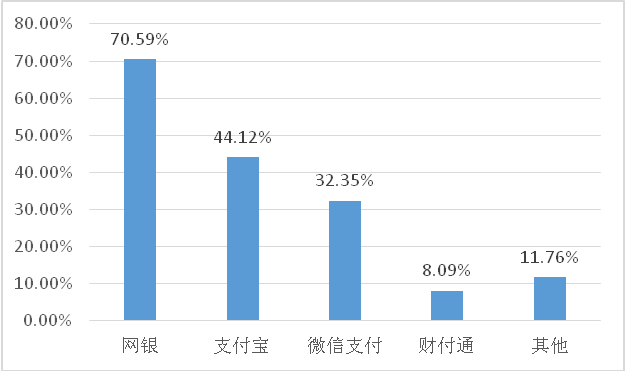

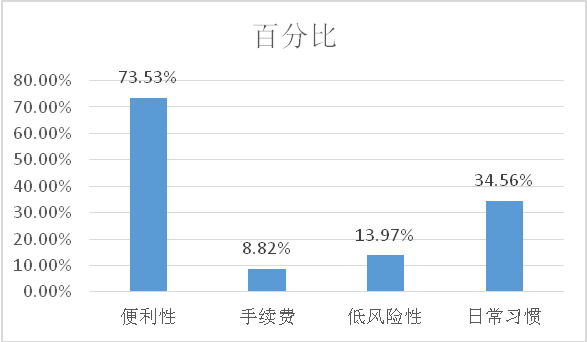

3.1.1 投资理财行为与支付行为 18

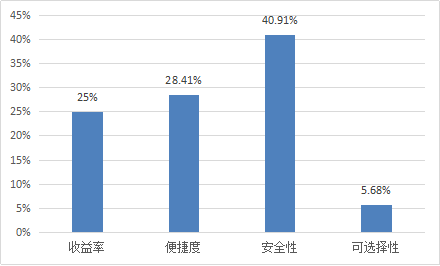

3.1.2 投资者行为影响因素 19

3.2 中介平台行为分析 23

3.2.1 借贷行为与融资行为 23

3.2.2 中介平台行为影响因素 25

3.3借款者行为分析 28

3.3.1 生产经营行为 28

3.3.2 借款者行为影响因素 29

第五章 互联网金融参与者行为风险与识别 32

4.1 风险识别的原则 32

4.2 投资者行为风险识别 33

4.3 中介平台行为风险识别 35

4.4 借款者行为风险识别 38

第六章 基于风险识别的风险监管措施 40

6.1 互联网金融的监管主体 40

6.2 操作风险和安全风险的监管措施 41

6.3 违约风险和运营风险的监管措施 42

6.4 流动性风险和道德风险的监管 44

结论与展望 47

致谢 48

参考文献 49

图表目录

图1.1 论文框架 5

图3.1 互联网金融的技术支持 9

表3.1 目前互联网行业的主要形式 10

图3.2 P2P网贷平台的运作模式 11

图3.3 第三方支付的主要消费领域 12

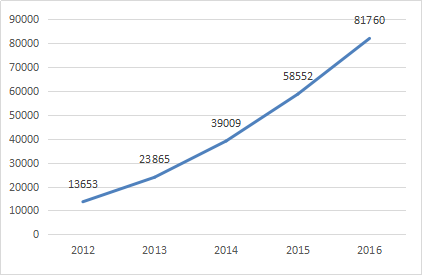

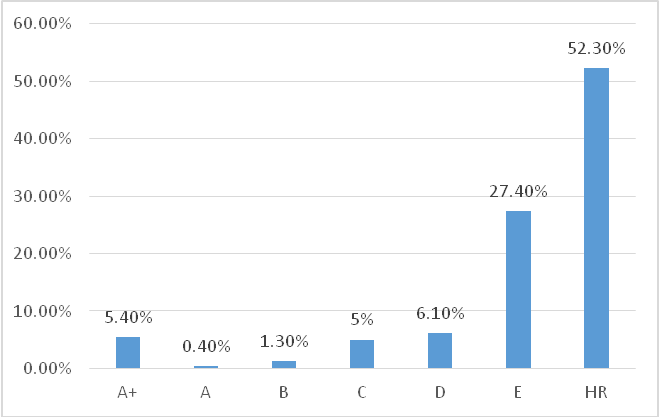

图3.4 近几年我国P2P平台数量增长情况 14

图3.5 近几年第三方支付市场交易量增长情况 15

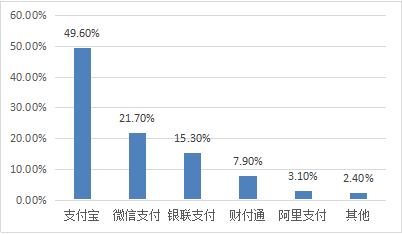

图3.6 主要大型第三方支付平台的市场份额 15

相关图片展示: