奶茶属性消费者偏好分析的联合分析方法外文翻译资料

2023-06-19 15:36:48

Consumer Preference Analysis on Attributes of Milk Tea: A Conjoint Analysis Approach

Abstract

Milk tea is a famous drink that has been heavily consumed since 2011. This study aimed to determine the combination of milk tea attributes that were most preferred using a Conjoint Analysis Approach. Specifically, this study utilized different attributes such as the size of tapioca pearls, sugar level, price range, brands, type of milk tea, cream cheese inclusion, and the amount of ice. Conjoint analysis with the orthogonal design was utilized to evaluate the preference of milk tea among consumers. The results showed that pearl size was the attribute most considered by consumers (29.137%), followed by sugar level (17.373%), the amount of ice (17.190%), the type of drink (13.421%), price (11.207%), and the least considered were cream cheese inclusion (9.525%) and the brands (2.147%). The findings of this study will be beneficial to milk tea firms about consumer preferences regarding the various attributes of milk tea. Finally, the result of this study could be applicable to different beverage-focused studies worldwide.

Keywords: milk tea; conjoint analysis; tapioca pearls; market analysis

1. Introduction

Milk tea is a famous tea-based drink that originated in Tainan and Taichung, Taiwan, in the 1980s [1]. It was invented by a Taiwanese tea shop owner, Liu Han-Chieh, and his product development manager, Lin Hsiu Hui [2]. The milk tea that we know today was discovered by adding different ingredients such as fruits, syrups, and tapioca pearls into different tea with milk beverages [2].

Milk tea first gained popularity in the 1990s throughout Asia and became more popular in the United States and Europe in the 2000s [3]. The popularity turned into a global phenomenon due to the versatility and flexibility of the toppings and flavor combinations that consumers could choose from [4]. With the global phenomenon of milk tea, it eventually hit the market with a $2.4 billion value in 2019 and is estimated to reach $4.3 billion by 2027 [1].

In the same article [1], the projection of the increase in the market will be in North America followed by Asia-Pacific, Europe, and LAMEA. For North America, it is said that the U.S. will be at the top followed by Canada and Mexico. For Europe, places like United Kingdom, Germany, France, and Italy will be the top regions. Moreover, Asia-Pacific has China as the top country followed by Japan, India, Australia, and Taiwan. LAMEA will cover Brazil, Saudi Arabia, South Africa, and Turkey [1].

Taking into consideration the components of milk tea, its sweet and original flavor was its selling point in different regions [1]. With its sweet flavor, it captured the hearts of people and eventually entered the beverage market [5]. Milk tea shops eventually spread and are located throughout malls, parks, and neighborhoods [6]. With that, the significant spread of milk tea shops has been observed around the world. Shops coming from different Asian regions like the Chatime group, CoCo, GongCha, all of which are from China and Taiwan, and Tiger Sugar from Korea, spread [7]. These brands eventually went international and people in those countries capitalized on the trend and made their own brands. Fortune Business Insight [7] included the U.S. brand Boba Loca Inc., Lollicup USA, Inc., and Kung Fu Tea. Moreover, United Kingdom has their own brand called Happy Lemon.

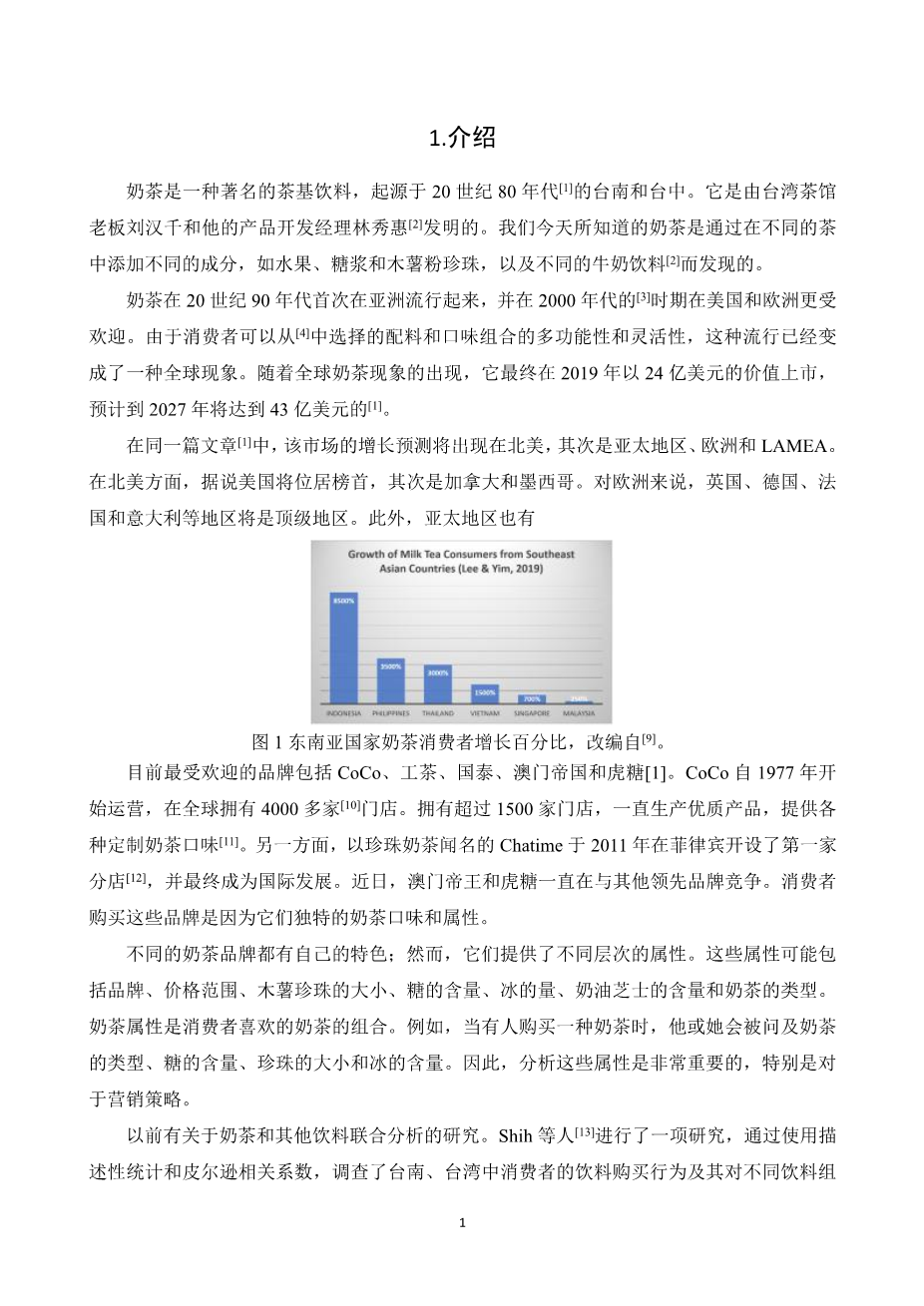

The different brands of milk tea became a huge option among consumers [8]. Con- sunji and Capili[8] found that consumers would prefer milk tea for its affordability compared to other popular beverages such as coffee. For that reason, milk tea became the largest bever- age trend starting in 2011. In Asia, milk tearsquo;s popularity significantly increased in 2018 with a 3500% growth, as indicated in Figure1[9]. Lee and Yim[9] then revealed that the Philippines and Thailand ranked second after a huge difference from Indonesia in Southeast Asia with the largest number of milk tea consumers. This implies that several milk teas brands, either local or international, are becoming more popular.

Figure 1. Percentage growth of milk tea consumers from Southeast Asian Countries. Adapted from [9].

Among the brands that are popular and are first in the market are CoCo, GongCha, Chatime, Macao Imperial, and Tiger Sugar [1]. CoCo has been operating since 1977, with over 4000 stores worldwide [10]. With over 1500 stores, GongCha has been producing quality products with a wide range of customized milk tea flavors [11]. On the other hand, Chatime, known for their pearl milk tea, opened their first branch in the Philippines in 2011[12] and eventually grew internationally. Recently, Macao Imperial and Tiger Sugar have been competing with other leading brands. Consumers have been buying these brands because of their distinct milk tea taste and attributes.

The different milk tea brands have their own specialty; however, they offer different levels of attributes. These attributes may include brands, price range, size of tapioca pearls, sugar level, the amount of ice, cream cheese inclusion, and the type of milk tea. Milk tea attributes are consumersrsquo; preferred set of combinations on their ordered milk tea. For instance, when someone buys a milk tea, he or she is being asked about the type of milk tea,

剩余内容已隐藏,支付完成后下载完整资料

英语译文共 26 页,剩余内容已隐藏,支付完成后下载完整资料

资料编号:[603830],资料为PDF文档或Word文档,PDF文档可免费转换为Word