基于回归分析与时间序列分析的浙江省房产价格指数模型及其比较外文翻译资料

2022-12-29 11:47:27

本科毕业设计(论文)

外文翻译

The Commodity Housing Price Analysis Model--Take Haikou (China) as an Example

作者:Bing-Qian Liu,Xiao-Yan Cao,Qi-Fan Yang amp; Yuan-Biao Zhang

国籍:China

出处:https://doi.org/10.5539/ijef.v10n8p43

Abstract

In recent decade years, the real-estate industry in China has achieved unprecedented development. Correspondingly, the rapid rise in house prices has led the government to introduce a series of macro-control policies. Based on the main regulatory mechanism of the purchase restriction policy, we take Haikou as an example to analysis the probable influence on housing price. We first select indicators from three aspects: supply, demand, and macroeconomic environment, and then establish a gray correlation model to extract the key factors of strong correlation, that is, real- estate investment, CPI, residential housing construction area, residential housing completion area. Moreover, we establish a multiple linear regression model based on GM (1, n) to obtain the multi-function relationship between commercial housing prices and these four key indicators. After that, we establish a population- purchases demand function model to predict the price of commercial housing in the coming year after introducing the purchase restriction policy. More significantly, we conclude that the purchase restriction policy can effectively regulate housing prices in the short term, but the long-term effect is limit.

Keywords: multiple grey predicting models, multiple linear regressions, population-purchase demand model

1. Introduction

Since the reform of housing market, the rapid development of real-estate industry in China has resulted in the rapid growth of housing prices while improving the housing conditions of residents. Especially since the 21st century, the housing prices in China have seen spurt growth. To curb the excessive growth of housing prices, the government has launched a series of restriction policies since 2010. The purpose of our paper is to analyze the impact of the restriction purchase policy on the residential housing prices. For the study of factors influencing commercial housing prices, Malpezzi (1992) used the error correction model to derive the effects of income changes and previous prices on housing prices and short-term supply of weak elasticities. Using quarterly data from 2004 to 2009 and the state-space model, Huang (2010) conducted a dynamic analysis of the impact of land prices and situational income on the price of commercial housing. By establishing VEC model and VAR model, Zhou (2015) analyzed the influence of interest rate changes upon the real-estate market. Yang and He (2016) used family households as a unit to examine the relationship between population migration, urbanization, and the housing market. Combining improved entropy weights and grey correlation analysis, Sun (2017) found that the level of residentsrsquo; purchasing power and regional economic development level had a significant impact on real estate prices, and followed by the level of infrastructure construction and real estate market environment affected real estate prices. Based on the Kriging spatial interpolation method, Wang et al. (2018) analyzed the trend of house prices in Wuhan, and found that the convenience of transportation, location business districts, ecological environment quality, complete service facilities, and urban planning had a positive and relevant influence on the prices of commercial housing. Regarding the effect of purchase restriction policy on housing price, Shu and Chen (2017) believed that the “Liberalizing Purchase Order” policy mainly restrains the investment demand of housing, while the impact on consumer demand is small. At the same time, the impact of the purchase restriction policy only exists in the short term. Wang and Cui (2017) studied the effect of the purchase restriction policy on the trading volume and housing price in the real estate market and found that the restricted purchase can significantly curb the increase in housing price, but it will show the characteristics of the early stage of price adjustment. Chen and Zhao (2018) used the fixed effect panel model and double difference model to empirically analyze the validity of the limited-credit and limit purchase policies.

However, the researches on the price of commercial housing in Hainan province are a little less. Lin et al. (2011) studied the effect of residential sales area and disposable income of urban residents on the sales price of residential houses in Hainan based on the ridge regression method. Employing the VAR model, Wu (2011) conducted an empirical analysis of the influencing factors of real estate prices in Hainan. In this paper, we first analyzed the price of commercial housing in Haikou from the perspective of supply and demand balance and established a population-demand function to further analyze the impact of the purchase restriction policy on future housing prices.

2. Methodology

2.1Build the Commercial Housing Price Model

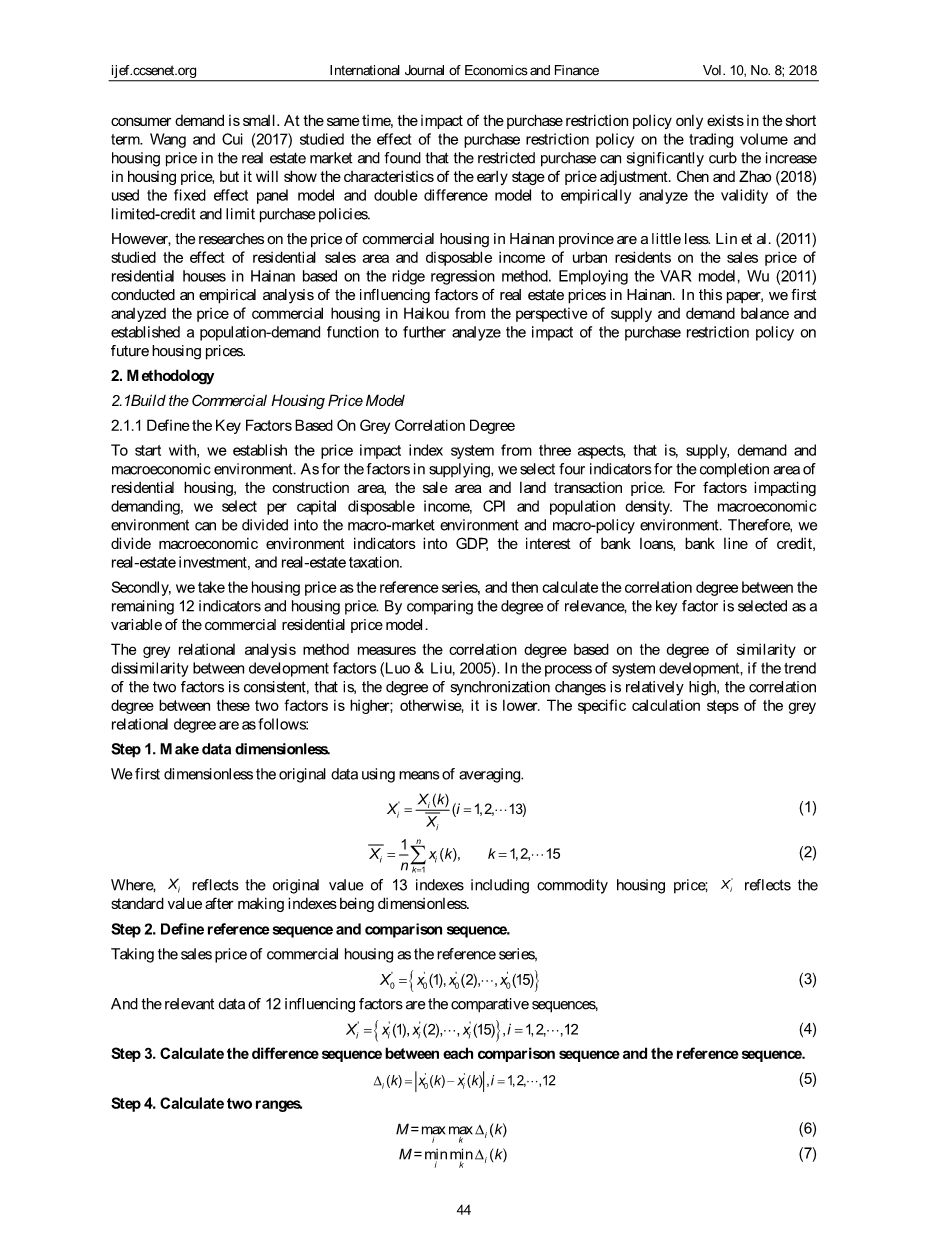

2.1.1 Define the Key Factors Based On Grey Correlation Degree

To start with, we establish the price impact index system from three aspects, that is, supply, demand and macroeconomic environment. As for the factors in supplying, we select four indicators for the completion area of residential housing, the construction area, the sale area and land transaction price. For factors impacting demanding, we select per capital disposable income, CPI and popula

剩余内容已隐藏,支付完成后下载完整资料

英语原文共 10 页,剩余内容已隐藏,支付完成后下载完整资料

资料编号:[276478],资料为PDF文档或Word文档,PDF文档可免费转换为Word